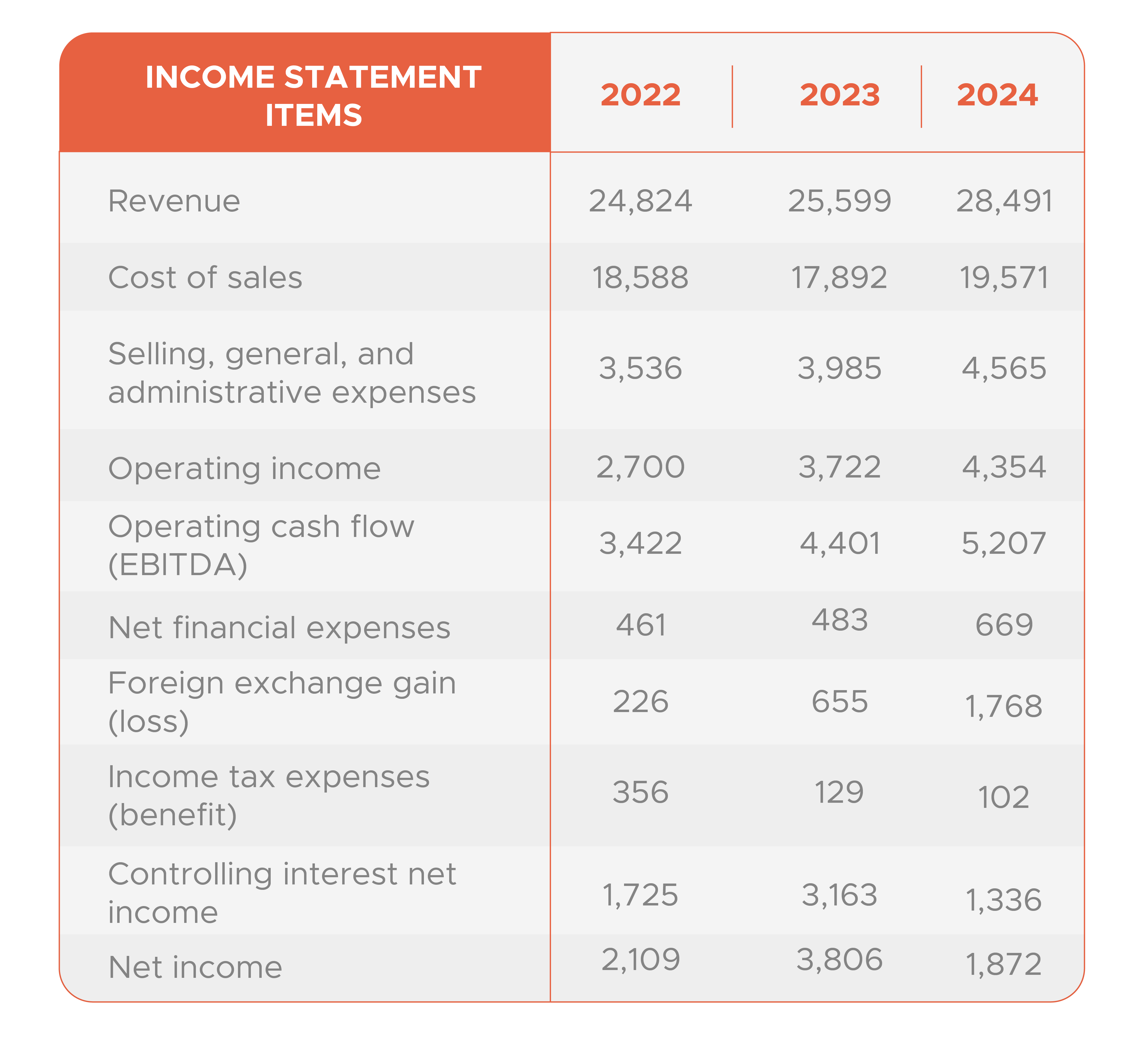

INCOME STATEMENT

SUMMARY

At the national level, 2024 ended with lower interest rates and reduced inflation. However, the outlook for Mexico remains uncertain due to recent political changes in its neighboring country, Mexico main trading partner.

In the case of the Group, our numbers speak for themselves, showing growth in most areas of the Income Statement and the Statement of Financial Position.

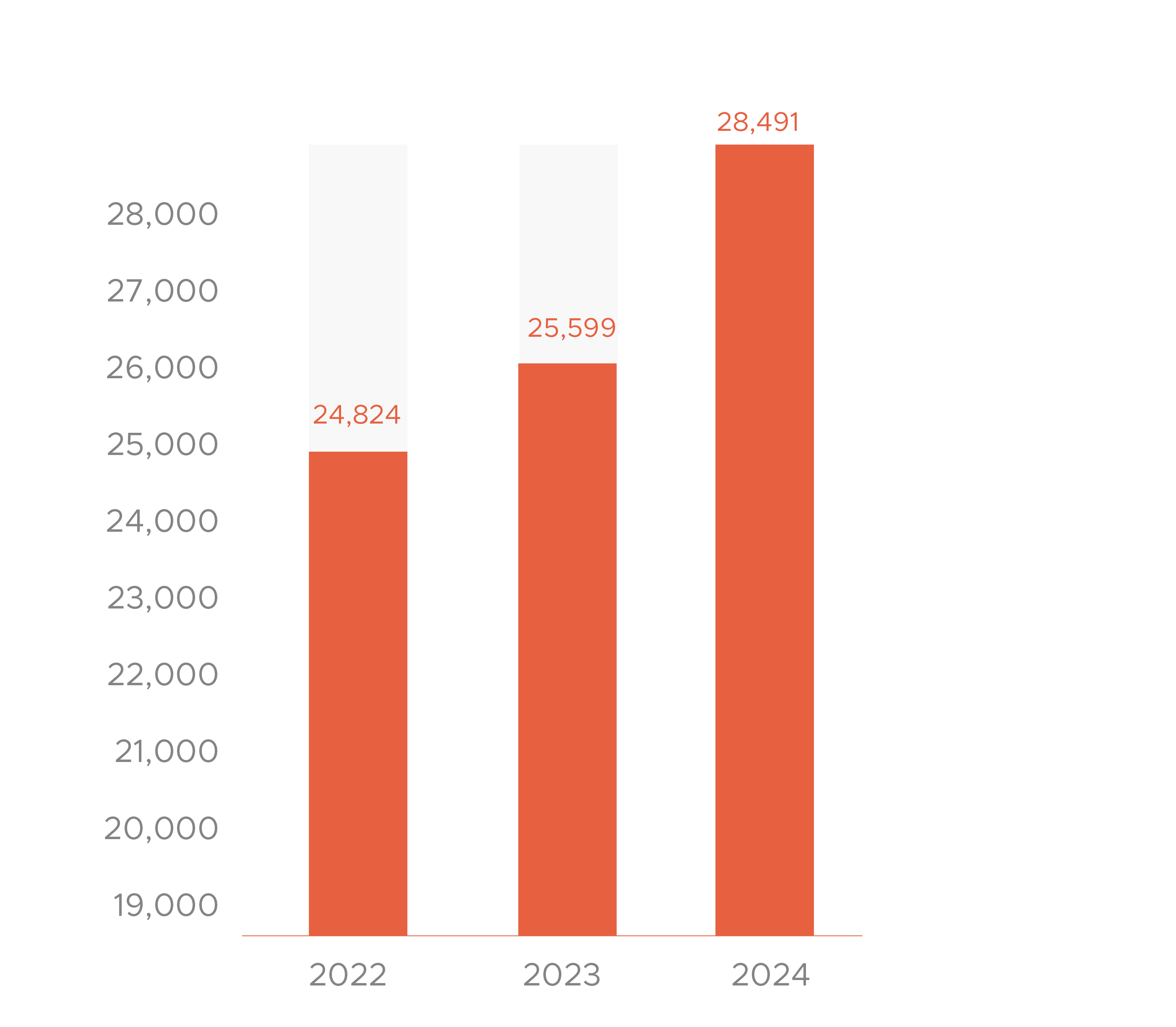

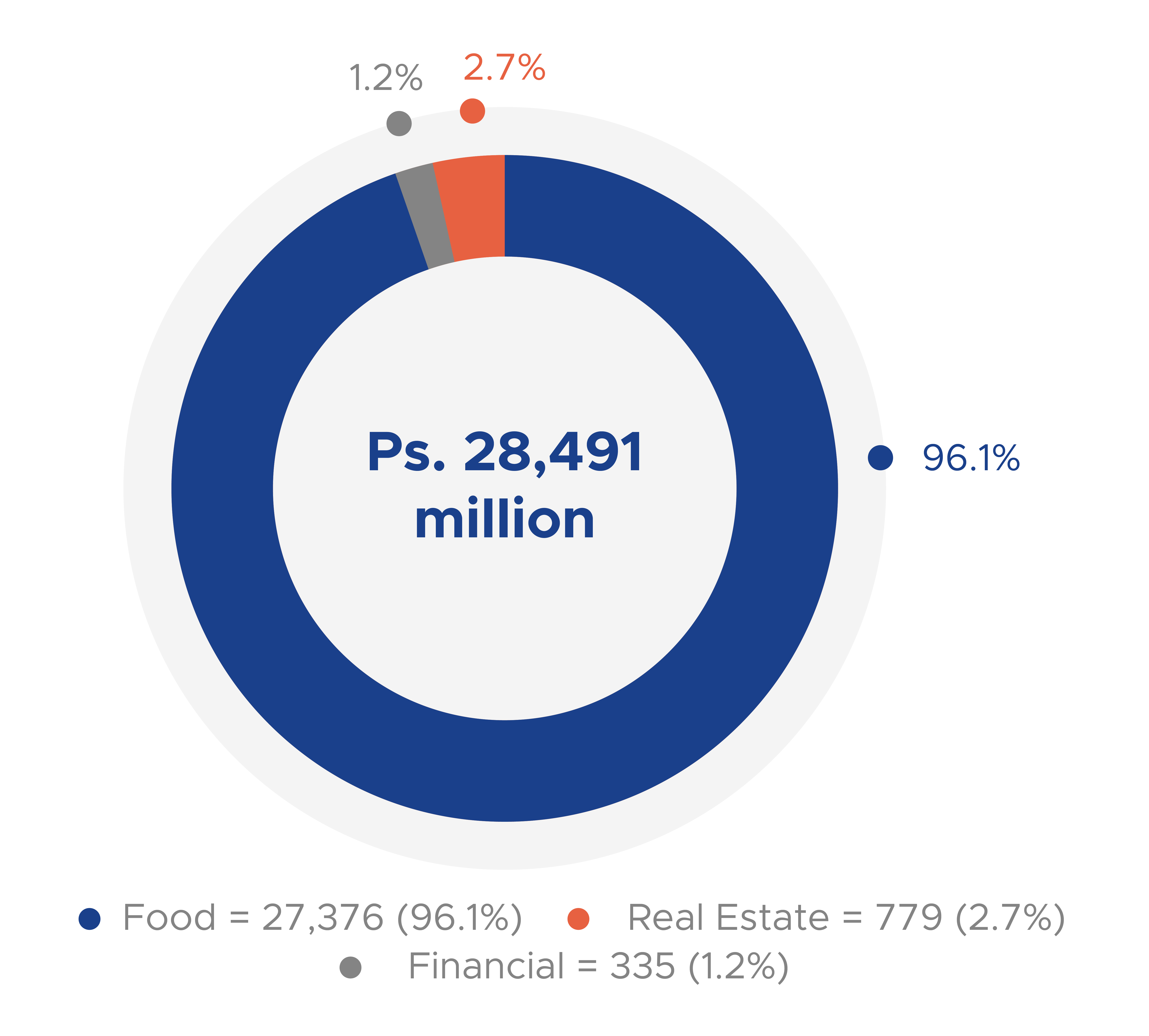

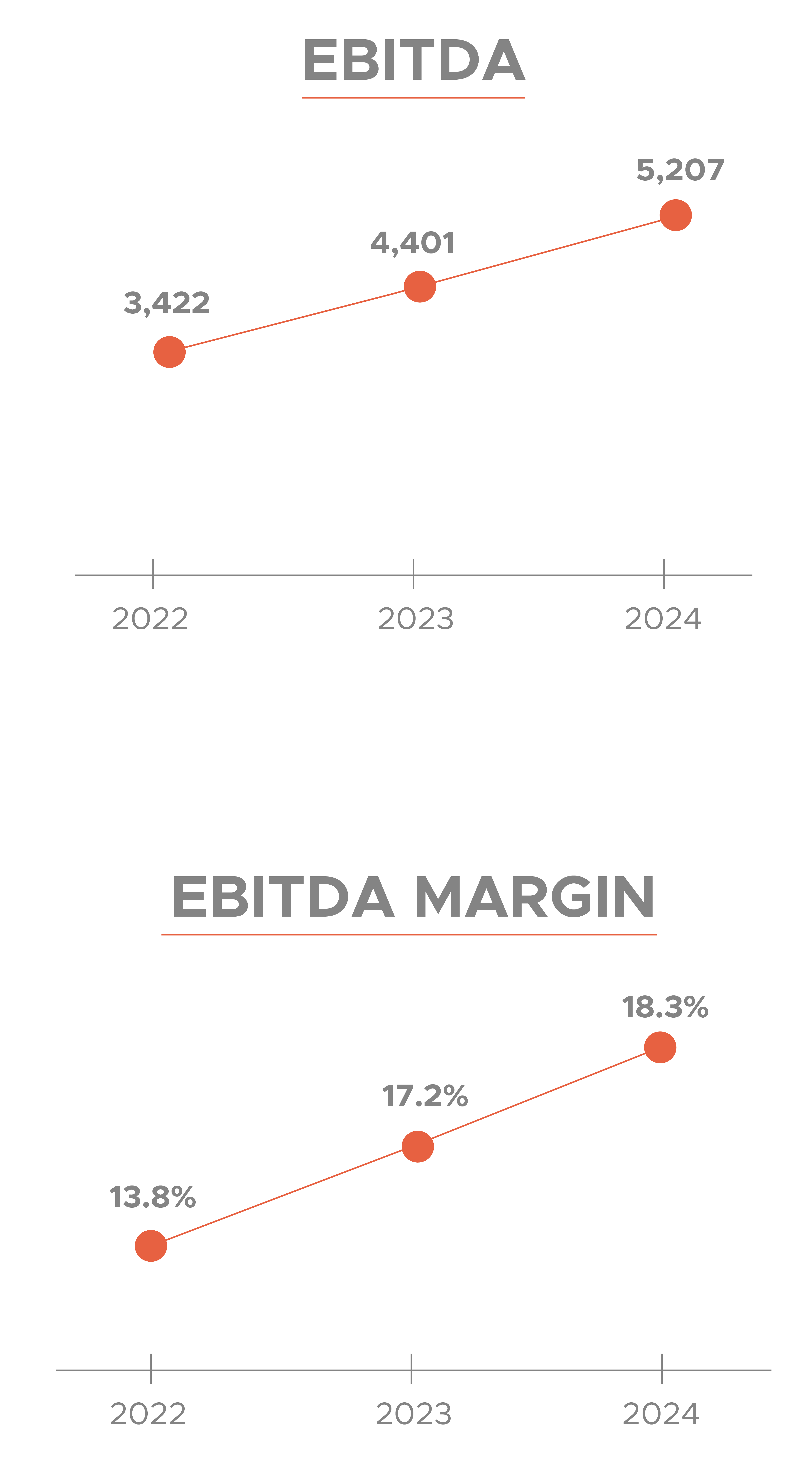

Grupo Bafar’s strong operating performance in 2024 reflects the team’s resilience and adaptability in a challenging environment. Net sales grew by 11.3%, driven by the expansion of the Retail channel and greater participation in key markets, both in Mexico and the U.S. This growth, coupled with improved operating efficiency, allowed operating profit to increase by 17% and EBITDA by 18.3%, reaching Ps. 5,207.3 million.

Despite a foreign exchange loss caused by the strengthening of the dollar and an increase in financial expenses, the Group maintained a solid financial position and continued investing in strategic infrastructure, with over Ps. 4,971.0 million allocated to industrial properties, new stores, and digitalization. The Group’s financial strategy, supported by sustainable loans and a natural hedge in dollars, has been key to maintaining stability in a global environment marked by uncertainty.